Salesforce Stock: The Latest News and Why It's Down

Salesforce just presented a vision of its future, and for a few hours, the market seemed to buy it. After the company’s Investor Day presentation, the `salesforce stock price` ticked up 3.56% in after-hours trading, a small green shoot in what has been a scorched-earth year for shareholders. Headlines like Salesforce stock jumps after company offers rosy forecast for 2030 were filled with ambitious targets: a revenue goal of over $60 billion by fiscal year 2030 and a new "50 by FY30" framework for profitable growth.

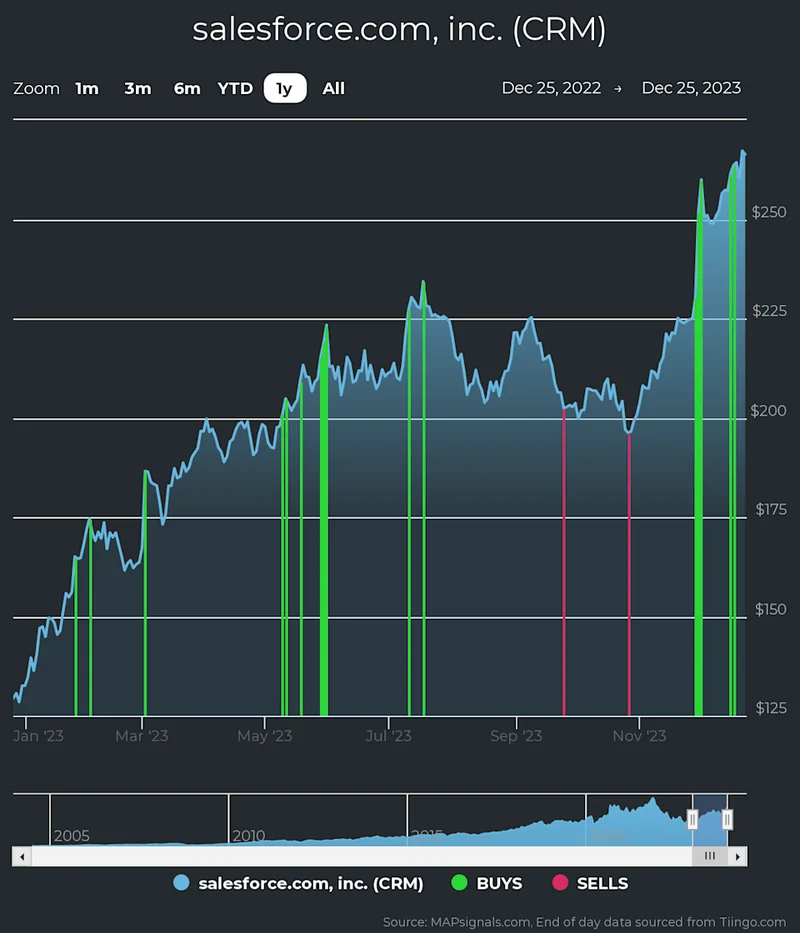

On the surface, it’s a compelling narrative. But it’s a narrative presented against a brutal backdrop. Before that after-hours bump, Salesforce shares were down roughly 30% year-to-date—to be more precise, 29.24% as of Wednesday’s close. The stock has fallen over 34% from its peak in January. That small after-hours pop is like a single candle lit in a stadium during a blackout. The gesture is noted, but it doesn't exactly illuminate the field.

The core tension is this: management is selling a story about 2030, while the `stock market` is punishing the company for its performance in 2025. Can a long-term forecast, no matter how rosy, reverse a deeply entrenched negative trend?

Deconstructing the Forecast

Let’s look at the numbers Salesforce put on the board. The $60 billion revenue target by FY2030 requires an organic compounded annual growth rate of over 10% from fiscal 2026 onward. This is paired with the “50 by FY30” framework, which stipulates that the sum of its subscription growth rate and its non-GAAP operating margin will reach 50. This is a classic move from the enterprise software playbook, designed to signal a mature focus on balancing expansion with profitability. It’s a message tailor-made for anxious investors.

But is a 10%+ CAGR the kind of growth that warrants a premium valuation in today’s market? For a company with a market cap north of $225 billion, it’s respectable, but it’s hardly the hyper-growth that defined its past. Competitors like Microsoft are already operating at a colossal scale with AI deeply integrated into their core offerings. The `oracle stock price` has also shown surprising resilience, suggesting the old guard is adapting. Salesforce isn't just competing with its past self; it's competing with the entire tech landscape's pivot to AI.

The social media reaction, which the source material notes, focused on the big, shiny numbers. This is predictable. A $60 billion target is easy to digest and tweet. A nuanced discussion about declining growth rates and margin pressures is not. So, what’s the engine that’s supposed to power this decade-long journey? Unsurprisingly, it’s AI.

The Agentforce Paradox

Salesforce is betting the farm on its AI platform, specifically Agentforce. The numbers here are, at first glance, impressive. The company’s Data and AI division posted $1.2 billion in revenue in the second quarter, a 120% year-over-year increase. Agentforce itself, its platform for autonomous AI agents, has reached an annual recurring revenue (ARR) of approximately $440 million with over 12,000 customers. CEO Marc Benioff called it the "fastest-growing organic product ever."

And this is the part of the presentation that I find genuinely puzzling. While a $440 million ARR is significant, it represents less than 2% of Salesforce’s trailing twelve-month revenue. The narrative weight being placed on this single product line to fundamentally alter the company's growth trajectory feels disproportionate. It’s like pointing to a promising rookie as proof that your aging baseball team is destined for the World Series. The potential is there, but it’s a long way from a guaranteed win.

Furthermore, the company noted that its platform reflects over $10 billion in organic R&D spending since the start of fiscal year 2024. This figure requires scrutiny. What exactly constitutes "organic R&D" in a company that has grown so aggressively through acquisition? How much of that is direct investment in new AI models versus the capitalized salaries of thousands of engineers working on integrating legacy systems? The data is simply insufficient to make a clear judgment, but the number feels designed for effect. Is this genuine innovation spending, or is it a marketing figure meant to rival the eye-popping R&D budgets of `microsoft stock` or `google stock`?

The adoption by major brands like Dell and PepsiCo is a qualitative positive, but it doesn't yet answer the quantitative question: can this one product line accelerate the growth of the entire multi-billion-dollar CRM behemoth enough to justify a reversal in the `crm stock price`? The market’s answer, so far, has been a resounding "no."

A Forecast in Search of a Trend

Ultimately, the Salesforce Investor Day was a masterclass in narrative management. It presented a clear, distant, and optimistic future to distract from a messy and painful present. The targets are ambitious, but they are just that: targets on a slide deck. They are an attempt to re-anchor investor expectations to a point far off in the horizon, hoping they'll ignore the turbulent waters immediately ahead.

The 3.56% after-hours jump wasn't a vote of confidence; it was a sigh of relief. It was a reaction to a presentation that wasn't a disaster. But it does nothing to change the fundamental data point that has defined the company this year: the persistent, grinding decline in its stock price. Until Agentforce's impressive growth rate translates into a material impact on the company's consolidated income statement, the market will likely treat these long-term promises with the skepticism they deserve. The gap between the 2030 forecast and the 2025 stock chart is the only story that matters right now.

-

The Business of Plasma Donation: How the Process Works and Who the Key Players Are

Theterm"plasma"suffersfromas...

-

ASML's Future: The 2026 Vision and Why Its Next Breakthrough Changes Everything

ASMLIsn'tJustaStock,It'sthe...

-

The Manyu Phenomenon: What Connects the Viral Crypto, the Tennis Star, and the Anime Legend

It’seasytodismisssportsasmer...

-

The Nebius AI Breakthrough: Why This Changes Everything

It’snotoftenthatatypo—oratl...

-

Secure Crypto: Unlock True Ownership - Reddit's HODL Guide

Alright,folks,let'stalkcrypto....

- Search

- Recently Published

-

- Misleading Billions: The Truth About DeFi TVL - DeFi Reacts

- Secure Crypto: Unlock True Ownership - Reddit's HODL Guide

- Altcoin Season is "here.": What's *really* fueling the latest altcoin hype (and who benefits)?

- The Week's Pivotal Blockchain Moments: Unpacking the breakthroughs and their visionary future

- DeFi Token Performance Post-October Crash: What *actual* investors are doing and the brutal 2025 forecast

- Monad: A Deep Dive into its Potential and Price Trajectory – What Reddit is Saying

- MSTR Stock: Is This Bitcoin's Future on the Public Market?

- OpenAI News Today: Their 'Breakthroughs' vs. The Broken Reality

- Medicare 2026 Premium Surge: What We Know and Why It Matters

- Accenture: What it *really* is, its stock, and the AI game – What Reddit is Saying

- Tag list

-

- Blockchain (11)

- Decentralization (5)

- Smart Contracts (4)

- Cryptocurrency (26)

- DeFi (5)

- Bitcoin (30)

- Trump (5)

- Ethereum (8)

- Pudgy Penguins (5)

- NFT (5)

- Solana (5)

- cryptocurrency (6)

- XRP (3)

- Airdrop (3)

- MicroStrategy (3)

- Plasma (4)

- Zcash (7)

- Aster (10)

- qs stock (3)

- mstr stock (3)

- asts stock (3)

- investment advisor (4)

- morgan stanley (3)

- ChainOpera AI (4)

- federal reserve news today (4)