Fed Rate Cut: What Happened and Why It's Not a Done Deal

Fed's Rate Cut: A Data-Impaired Decision?

Navigating the Fog: The Fed's October Rate Cut

On Wednesday, October 29, 2025, the Federal Reserve lowered its benchmark interest rate by 25 basis points, setting the target range at 3.75% to 4.00%. It wasn't a unanimous decision; the vote was 10-2, with Stephen Miran pushing for a more aggressive cut and Jeffrey Schmid preferring to hold steady. While a rate cut might sound straightforward, the circumstances surrounding this decision are anything but.

The elephant in the room? The ongoing government shutdown. The Fed is essentially flying blind, operating without crucial economic data that normally informs its decisions. Think of it like trying to navigate a ship through a dense fog with a broken radar. They're forced to rely on high-frequency and sentiment data – which, let's be honest, have consistently underestimated the U.S. economy's resilience in recent quarters.

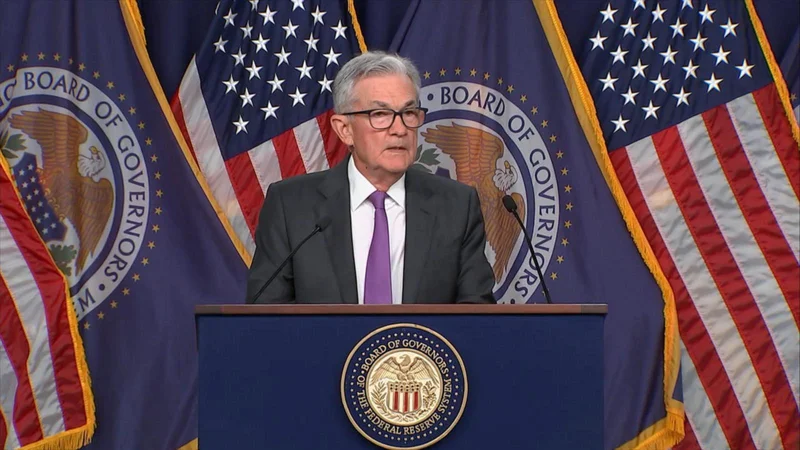

Fed Chair Jerome Powell's statement that another rate cut in December is "not a foregone conclusion" underscores the uncertainty. The FOMC itself is reportedly divided on the path forward. And while the Fed is considering ending its balance sheet reduction (quantitative tightening), this data blackout throws a wrench into any long-term planning. Fed meeting recap: Powell says another rate cut in December 'is not a foregone conclusion' - CNBC

The shutdown's impact is quantifiable. The Congressional Budget Office (CBO) estimates a hit of at least $7 billion to GDP by the end of 2026. But the real concern for the Fed seems to be the labor market. They're watching layoffs at major U.S. companies "very, very carefully," particularly in the context of AI-driven job displacement. Amazon (14,000 jobs), Paramount (at least 1,000), UPS (a staggering 48,000 this year), and Target (1,800 corporate roles) are just a few examples.

This paints a picture of a Fed caught between a rock and a hard place. On one hand, they're facing persistent inflation. On the other, they're seeing "downside risks to employment" rising. It's their dual mandate – keep unemployment and inflation low – creating a particularly thorny situation to navigate. They’re making what they’re calling a “risk management” move, which seems to be code for trying to preempt a potential labor market collapse.

High-Frequency Data: A Risky Reliance

The Fed's increased reliance on high-frequency and sentiment data raises some serious questions. These alternative data sources, while readily available, are inherently less reliable and more prone to bias than official government statistics. Are they truly capturing the nuances of the labor market, or are they simply reflecting the loudest voices on social media? It's like trying to diagnose a patient based on their WebMD searches – you might get some clues, but you're missing the full clinical picture.

And this is the part of the report that I find genuinely puzzling. The Fed is acknowledging the lack of data, even qualifying the way it categorizes broad economic conditions, but still making a significant policy decision based on incomplete information. They've gone four weeks without government data, but what little they do have points to a softening labor market. This suggests they're willing to tolerate a higher risk of being wrong, perhaps fearing the consequences of inaction more than the risk of overreacting.

Consider this: The Fed is worried about slow job creation potentially turning into a full-blown contraction and recession. But what if the high-frequency data is exaggerating the weakness in the labor market? What if the underlying economy is actually more resilient than these alternative indicators suggest? If the Fed is wrong, they risk prematurely easing monetary policy, potentially fueling inflation and creating asset bubbles.

Blindfolded in the Minefield

The Fed's current predicament is a stark reminder of the importance of reliable economic data. Operating without it is like navigating a minefield blindfolded. The rate cut itself wasn't surprising, given the prevailing concerns about the labor market. But the data-impaired context in which it was made raises serious doubts about its wisdom. The Fed is essentially making a high-stakes gamble based on gut feeling and incomplete information. We’ll see if it pays off.

A Hunch-Driven Gamble?

-

The Manyu Phenomenon: What Connects the Viral Crypto, the Tennis Star, and the Anime Legend

It’seasytodismisssportsasmer...

-

The Business of Plasma Donation: How the Process Works and Who the Key Players Are

Theterm"plasma"suffersfromas...

-

ASML's Future: The 2026 Vision and Why Its Next Breakthrough Changes Everything

ASMLIsn'tJustaStock,It'sthe...

-

The Nebius AI Breakthrough: Why This Changes Everything

It’snotoftenthatatypo—oratl...

-

Secure Crypto: Unlock True Ownership - Reddit's HODL Guide

Alright,folks,let'stalkcrypto....

- Search

- Recently Published

-

- Misleading Billions: The Truth About DeFi TVL - DeFi Reacts

- Secure Crypto: Unlock True Ownership - Reddit's HODL Guide

- Altcoin Season is "here.": What's *really* fueling the latest altcoin hype (and who benefits)?

- The Week's Pivotal Blockchain Moments: Unpacking the breakthroughs and their visionary future

- DeFi Token Performance Post-October Crash: What *actual* investors are doing and the brutal 2025 forecast

- Monad: A Deep Dive into its Potential and Price Trajectory – What Reddit is Saying

- MSTR Stock: Is This Bitcoin's Future on the Public Market?

- OpenAI News Today: Their 'Breakthroughs' vs. The Broken Reality

- Medicare 2026 Premium Surge: What We Know and Why It Matters

- Accenture: What it *really* is, its stock, and the AI game – What Reddit is Saying

- Tag list

-

- Blockchain (11)

- Decentralization (5)

- Smart Contracts (4)

- Cryptocurrency (26)

- DeFi (5)

- Bitcoin (30)

- Trump (5)

- Ethereum (8)

- Pudgy Penguins (5)

- NFT (5)

- Solana (5)

- cryptocurrency (6)

- XRP (3)

- Airdrop (3)

- MicroStrategy (3)

- Plasma (4)

- Zcash (7)

- Aster (10)

- qs stock (3)

- mstr stock (3)

- asts stock (3)

- investment advisor (4)

- morgan stanley (3)

- ChainOpera AI (4)

- federal reserve news today (4)