Zcash (ZEC): An Analysis of Price Predictions vs. Core Fundamentals

The Zcash Paradox: Why Isn't the World's Most Private Crypto Winning?

In the digital ledger of the crypto world, every transaction is supposed to be an immutable entry, carved in cryptographic stone for all to see. Bitcoin’s blockchain is a testament to this—a radically transparent financial system where every satoshi’s journey is public record. Then there’s Zcash. It arrived with a promise that was, and still is, the antithesis of Bitcoin’s design philosophy: true financial privacy. Using some of the most advanced cryptography ever deployed in a public system, Zcash offers users the ability to transact in complete, verifiable anonymity.

This presents a paradox that has puzzled analysts for years. In a market ostensibly born from a cypherpunk desire for privacy and autonomy, why has Zcash consistently failed to capture significant market share? The `Zcash price` has languished against `Bitcoin`, and its adoption metrics tell a story of profound user ambivalence.

The data suggests a fundamental disconnect. Zcash is a brilliant technical solution to a problem that the majority of the market, despite its rhetoric, doesn't seem sufficiently motivated to solve. It’s a case study in what happens when revolutionary technology meets lukewarm demand.

The Engineering Marvel of Anonymity

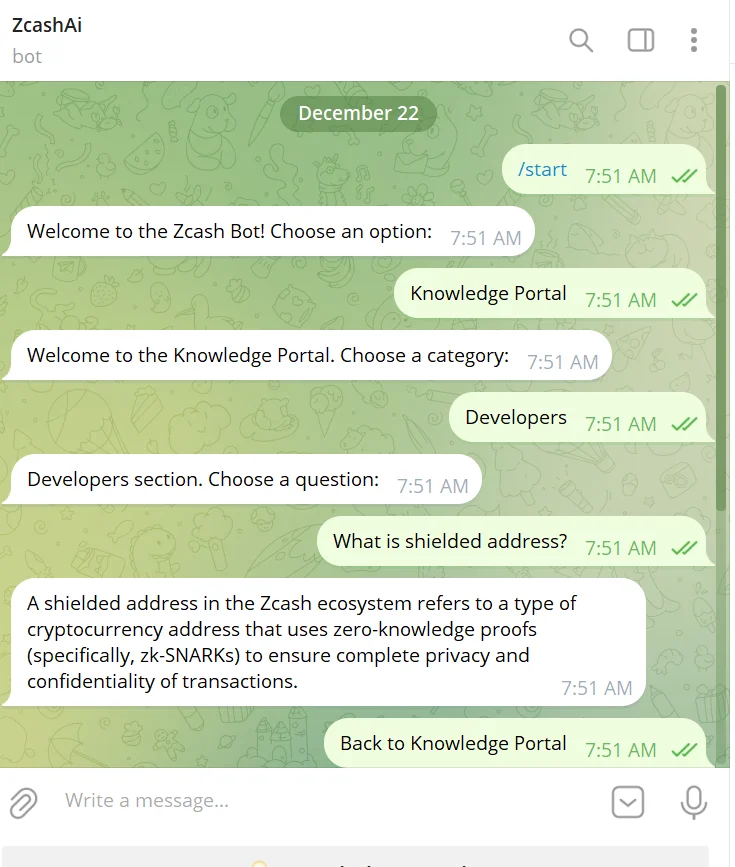

To understand Zcash, you have to appreciate the elegance of its core technology. Unlike Bitcoin or Ethereum, `Zcash crypto` offers two types of addresses: transparent addresses (t-addresses), which function just like Bitcoin’s, and shielded addresses (z-addresses), which are completely private. Transactions between z-addresses are recorded on the blockchain, but the sender, receiver, and amount are all encrypted.

The magic that makes this possible is a cryptographic technique called zk-SNARKs (Zero-Knowledge Succinct Non-Interactive Arguments of Knowledge). This allows a user to prove that a transaction is valid—that they have the funds and aren’t double-spending—without revealing any of the underlying data. When you view a shielded transaction on a block explorer, all you see is confirmation that a valid transaction occurred. The rest is a black box. It’s the digital equivalent of handing someone cash in a locked room; the exchange happens, but the outside world has no details.

From a purely technical standpoint, this is a monumental achievement. It delivers on the original promise of electronic cash in a way that pseudo-anonymous systems like Bitcoin never could. So, if the technology is so superior for privacy, why isn't everyone who values discretion using it? Why hasn’t the `ZEC` coin become the default currency for confidential commerce?

Where the Data Tells a Different Story

This is where we move from the elegance of the whitepaper to the brutal honesty of the market. The story of Zcash’s adoption is best told through its "shielded pool," the total amount of `ZEC` held in private z-addresses. This single metric is the most direct measure of how much users are embracing the platform's core value proposition. And the numbers have been, for most of its history, underwhelming.

For years, the vast majority of Zcash transactions were transparent. Users were holding `ZEC` on exchanges like `Coinbase` or in wallets but weren't bothering to move their funds into the shielded pool. Usage of the privacy feature hovered in the low single digits for a long time. While recent network upgrades have improved the situation, a huge portion of the coin's activity remains transparent. It’s like designing a state-of-the-art submarine that most of its crew insists on sailing on the surface.

I've analyzed market adoption curves for dozens of technologies, and this particular pattern—a platform's core feature being so dramatically underutilized—is a significant red flag for product-market fit. The total value of the shielded pool has grown, but it remains a fraction of the asset's total market capitalization. We’re talking about a utilization rate that, for much of its life, was less than 15%—to be more exact, it often struggled to stay above 10%.

This creates a feedback loop. Low usage of the shielded pool creates a smaller "anonymity set," which theoretically makes it easier to de-anonymize transactions through metadata analysis. This, in turn, may discourage more users from opting in, creating a persistent state of underutilization.

This is the Zcash paradox in its starkest form. It’s a high-performance privacy engine in a world where most drivers are content with the speed limit. The technology offers a level of financial confidentiality that is second to none, yet the on-chain data reveals a user base that overwhelmingly defaults to transparency. What does this tell us about the crypto market’s actual priorities? Is "privacy" a feature users champion ideologically but avoid in practice due to usability hurdles, regulatory fears, or simple indifference?

Analyzing qualitative data from community forums like `Reddit Zcash` quantifies this tension. The discussions aren't just about `zcash price prediction`; they are dominated by recurring debates over the "trusted setup" ceremony required for its cryptography, the perpetual funding for the Electric Coin Company, and the competitive threat from simpler privacy models like `Monero`. These aren't just forum arguments; they are quantifiable indicators of friction and doubt that act as a drag on adoption and, consequently, price.

A Solution in Search of a Problem

My analysis leads to a clinical, if unsatisfying, conclusion. Zcash is a masterpiece of cryptographic engineering. It provides a robust, elegant solution for on-chain financial privacy. But the market, in its relentless and unsentimental calculus, has largely rendered its verdict: for now, that solution is a niche feature, not a revolution. The data doesn't suggest a failed project, but rather a miscalculation of the market's true desires. Users have demonstrated through their actions—or lack thereof—that the radical transparency of Bitcoin, for all its flaws, is good enough. For Zcash to truly win, it needs more than just superior code. It needs a catalyst, a compelling event that transforms its powerful privacy from a "nice-to-have" into a "must-have" for a critical mass of users. Until that day comes, it remains one of the most fascinating technological marvels in search of a widespread problem to solve.

-

The Business of Plasma Donation: How the Process Works and Who the Key Players Are

Theterm"plasma"suffersfromas...

-

The Manyu Phenomenon: What Connects the Viral Crypto, the Tennis Star, and the Anime Legend

It’seasytodismisssportsasmer...

-

ASML's Future: The 2026 Vision and Why Its Next Breakthrough Changes Everything

ASMLIsn'tJustaStock,It'sthe...

-

The Nebius AI Breakthrough: Why This Changes Everything

It’snotoftenthatatypo—oratl...

-

The Great Up-Leveling: What's Happening Now and How We Step Up

Haveyoueverfeltlikeyou'redri...

- Search

- Recently Published

-

- Misleading Billions: The Truth About DeFi TVL - DeFi Reacts

- Secure Crypto: Unlock True Ownership - Reddit's HODL Guide

- Altcoin Season is "here.": What's *really* fueling the latest altcoin hype (and who benefits)?

- The Week's Pivotal Blockchain Moments: Unpacking the breakthroughs and their visionary future

- DeFi Token Performance Post-October Crash: What *actual* investors are doing and the brutal 2025 forecast

- Monad: A Deep Dive into its Potential and Price Trajectory – What Reddit is Saying

- MSTR Stock: Is This Bitcoin's Future on the Public Market?

- OpenAI News Today: Their 'Breakthroughs' vs. The Broken Reality

- Medicare 2026 Premium Surge: What We Know and Why It Matters

- Accenture: What it *really* is, its stock, and the AI game – What Reddit is Saying

- Tag list

-

- Blockchain (11)

- Decentralization (5)

- Smart Contracts (4)

- Cryptocurrency (26)

- DeFi (5)

- Bitcoin (30)

- Trump (5)

- Ethereum (8)

- Pudgy Penguins (5)

- NFT (5)

- Solana (5)

- cryptocurrency (6)

- XRP (3)

- Airdrop (3)

- MicroStrategy (3)

- Plasma (4)

- Zcash (7)

- Aster (10)

- qs stock (3)

- mstr stock (3)

- asts stock (3)

- investment advisor (4)

- morgan stanley (3)

- ChainOpera AI (4)

- federal reserve news today (4)