RKLB Stock: The Data Behind the Surge and Its Real Value

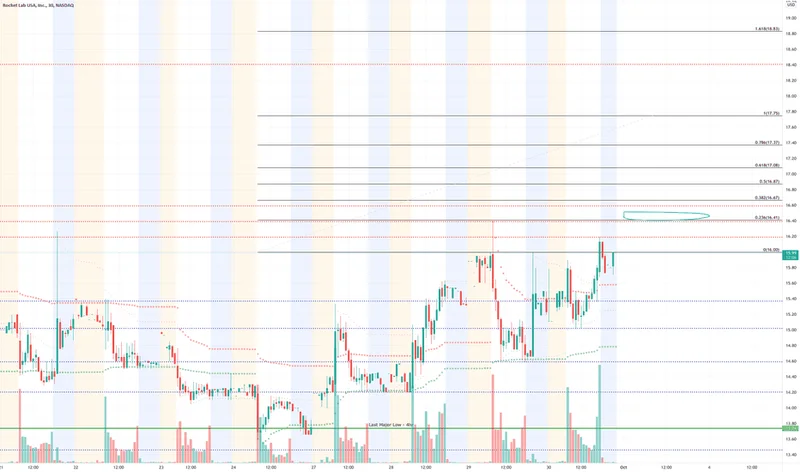

The premarket screen glowed with a familiar, almost Pavlovian, shade of green. Rocket Lab (RKLB) was up, and not by a trivial amount. The ticker showed a 7.27% jump before the opening bell, a surge prompted by what appeared to be a straightforward press release: a new multi-launch deal with Japanese earth-imaging firm iQPS.

Most of the retail chatter and algorithmic trading bots likely processed this as simple, positive news. New contract equals more revenue. More revenue equals stock goes up. It’s a clean, linear equation that satisfies the market’s insatiable appetite for good news. But when you peel back the initial layer of this announcement, the real story isn't about three more launches on the manifest. It’s about something far more fundamental to Rocket Lab’s entire investment thesis: cadence.

The headline number is three dedicated Electron missions for iQPS, slated to begin in 2026. This brings the total number of launches booked by this single client to seven. That’s an impressive figure for a small launch provider, but it’s the historical context that gives it weight. Rocket Lab has already completed four launches for iQPS this year alone. Two of those occurred within a tight four-week window between May and June.

This isn’t just a contract; it’s a data point proving a hypothesis. For years, the bull case for Rocket Lab has rested on its ability to transition from a boutique, one-off launch service to a high-frequency, production-line-style operation. The company has publicly targeted a capacity of 20 or more missions in 2025. That’s a bold claim. But the iQPS relationship provides the first tangible, external validation of that operational tempo. You don't sign a client for seven total launches unless you’ve proven you can execute reliably and frequently. What we're seeing isn't just a sale, it's a stress test of their entire production and launch infrastructure, and they appear to be passing.

The System is the Product

It’s easy to get fixated on the rocket. The fire, the noise, the sheer spectacle of it all—it’s what captures the imagination. But the rocket is just the delivery truck. The real product, the one that creates a sticky and defensible business model, is the entire logistics system. And that’s the second, more subtle signal embedded in this iQPS deal.

Sir Peter Beck, Rocket Lab’s founder, wasn't just celebrating the launches. His statement highlighted the "highly-integrated launch service" that iQPS was leveraging. This is more than just marketing fluff. Each mission will use Rocket Lab’s own Motorized Lightband separation system to deploy the iQPS satellites. This is a critical detail. Rocket Lab isn’t just flying a customer’s payload; they're providing proprietary hardware that is integral to the mission's success. They are embedding themselves into the client’s operational DNA.

This is the aerospace equivalent of the Apple ecosystem. You buy the iPhone, but soon you have the watch, the AirPods, and the iCloud subscription. By providing both the launch and the critical separation hardware, Rocket Lab increases switching costs and becomes less of a commoditized service provider and more of a mission partner. The value isn't in a single launch contract; it’s in the lifetime value of a client that is now deeply integrated into your technology stack. I've looked at hundreds of these aerospace filings, and this particular pattern of vertical integration—from components to launch—is where the durable long-term value is actually created.

The market’s 7.27% premarket pop was a reaction to the number of launches. The real story, however, is the operational cadence and the technical integration. These elements don't show up as a single, clean line item on a quarterly report, but they are the foundational pillars of the post-2030 value proposition that some analysts are already pointing toward (Rocket Lab’s True Value Story Starts After 2030, Here’s Why I’m Still Bullish (RKLB)). The question this deal raises is a crucial one: is the iQPS model—a high-frequency launch schedule coupled with integrated hardware sales—the blueprint for how Rocket Lab will capture the coming wave of satellite constellation deployments? And if so, how many other iQPS-style clients are currently in their pipeline? The answer to that is where the real alpha lies, not in a one-day stock chart.

A Factory, Not a Firework Show

Let’s be clear: the small-launch market is unforgiving. It’s capital-intensive, technically fraught, and crowded with competitors who are often propped up by government funding or venture capital optimism. Survival, let alone dominance, requires a ruthless focus on efficiency and reliability. The romance of space exploration is a great marketing tool, but it doesn't pay the bills. What pays the bills is turning a rocket launch into a repeatable, predictable, and frankly, boring industrial process.

Rocket Lab's stated goal of 20-plus launches next year, supported by the demonstrated cadence with iQPS, signals a shift in thinking. They are building a launch factory, not a series of bespoke science projects. The iQPS deal is a certificate of performance for that factory. It proves they can handle the assembly line's speed. Each successful launch for this client is like a unit of production rolling off the line, validating the process and building a track record that is invaluable for securing future, larger constellation contracts.

Think of it like this: the first launch for a new client is a sales pitch. The second is a confirmation. But the fifth, sixth, and seventh launches? That's just business as usual. It's the moment the process becomes mundane. And in the world of manufacturing and logistics, "mundane" is the highest compliment you can get. It means the system works. The premarket traders were excited about a firework show. The long-term investors should be looking at the factory that builds the fireworks, and right now, that factory looks like it’s starting to hum.

It's an Operations Story, Not a Rocket Story

Ultimately, the market’s reaction was both right and wrong. It was right to identify the iQPS announcement as a significant positive catalyst. It was wrong, I believe, in its focus. The excitement shouldn't be about a three-launch contract. It should be about the quiet, behind-the-scenes data that this contract illuminates: the proven ability to launch frequently, the successful integration of proprietary hardware, and the validation of a factory-like production model. This isn't about the glamour of space. It's about the gritty, unsexy, and immensely valuable business of logistics. The iQPS deal is the clearest signal yet that Rocket Lab understands this distinction, even if the market doesn't fully grasp it yet.

-

The Business of Plasma Donation: How the Process Works and Who the Key Players Are

Theterm"plasma"suffersfromas...

-

ASML's Future: The 2026 Vision and Why Its Next Breakthrough Changes Everything

ASMLIsn'tJustaStock,It'sthe...

-

The Manyu Phenomenon: What Connects the Viral Crypto, the Tennis Star, and the Anime Legend

It’seasytodismisssportsasmer...

-

The Nebius AI Breakthrough: Why This Changes Everything

It’snotoftenthatatypo—oratl...

-

Secure Crypto: Unlock True Ownership - Reddit's HODL Guide

Alright,folks,let'stalkcrypto....

- Search

- Recently Published

-

- Misleading Billions: The Truth About DeFi TVL - DeFi Reacts

- Secure Crypto: Unlock True Ownership - Reddit's HODL Guide

- Altcoin Season is "here.": What's *really* fueling the latest altcoin hype (and who benefits)?

- The Week's Pivotal Blockchain Moments: Unpacking the breakthroughs and their visionary future

- DeFi Token Performance Post-October Crash: What *actual* investors are doing and the brutal 2025 forecast

- Monad: A Deep Dive into its Potential and Price Trajectory – What Reddit is Saying

- MSTR Stock: Is This Bitcoin's Future on the Public Market?

- OpenAI News Today: Their 'Breakthroughs' vs. The Broken Reality

- Medicare 2026 Premium Surge: What We Know and Why It Matters

- Accenture: What it *really* is, its stock, and the AI game – What Reddit is Saying

- Tag list

-

- Blockchain (11)

- Decentralization (5)

- Smart Contracts (4)

- Cryptocurrency (26)

- DeFi (5)

- Bitcoin (30)

- Trump (5)

- Ethereum (8)

- Pudgy Penguins (5)

- NFT (5)

- Solana (5)

- cryptocurrency (6)

- XRP (3)

- Airdrop (3)

- MicroStrategy (3)

- Plasma (4)

- Zcash (7)

- Aster (10)

- qs stock (3)

- mstr stock (3)

- asts stock (3)

- investment advisor (4)

- morgan stanley (3)

- ChainOpera AI (4)

- federal reserve news today (4)