Another FOMC Minutes Dump: Translating the Gibberish So You Don't Have To

So the Fed dropped its latest meeting minutes, and everyone in the financial media is dutifully parsing the tea leaves like it’s some sacred text handed down from on high. Let me save you the trouble: it’s a mess.

The official story is that the Federal Open Market Committee voted a resounding 11-1 to cut interest rates. Unity! Consensus! See, Mom and Dad aren’t fighting! But read between the lines of this masterclass in bureaucratic doublespeak, and you see a committee that’s about as unified as a pack of wolves arguing over the last piece of meat.

This isn’t a ship with a steady hand on the tiller. This is a ship where half the crew is screaming "full steam ahead" while the other half is trying to drop anchor, and the captain is just smiling for the cameras telling us the seas have never been calmer.

The Illusion of Consensus

Let’s get this straight. The big headline vote was 11-1. Looks decisive, right? But then you dig into the actual projections—the "dot plot" where everyone shows their cards—and you find a razor-thin 10-9 split on what to do for the rest of the year. Ten of them want to keep cutting. Nine of them are less sure. That’s not a consensus; that’s a coin flip. Divided Fed officials saw another two interest rate cuts by the end of 2025, minutes show.

The minutes are filled with glorious, meaningless phrases like this gem: “almost all participants noted that, with the reduction in the target range for the federal funds rate at this meeting, the Committee was well positioned to respond in a timely way to potential economic developments.”

My translation? "We just did something so you'd stop yelling at us, and now we have no freaking clue what to do next, but please believe we're prepared." It’s the institutional equivalent of a kid who cleans his room by shoving everything under the bed. It looks fine on the surface, but the underlying chaos is still there.

The whole thing is like a deeply dysfunctional family trying to decide on a vacation. The vote to "go somewhere" passes easily. But then you realize half the family wants to go skiing and the other half wants a beach, and they secretly despise each other's choices. The Fed just voted to "go on vacation" by cutting rates a quarter-point. But the fight over the destination is just getting started, and it's going to be ugly.

And then you have the new guy, Governor Stephen Miran. He’s the one dissenter, the lone vote against the piddly quarter-point cut. He wanted to go for a full half-point. The minutes, offcourse, don't name names, but the post-meeting statement outed him. Miran is basically the committee’s new radical, the guy who shows up to the party and says what everyone else is secretly thinking: the economy is weaker than we’re letting on, and these baby steps ain’t gonna cut it. Is he a prophet seeing the coming storm, or just a new appointee trying to make a name for himself? And does it even matter when the rest of the committee is busy pretending they all agree?

A Dollar Rally Built on Quicksand

While the Fed is busy with its internal drama, the US dollar is supposedly on a tear. The DXY is at a two-month high. But let’s not kid ourselves. This isn’t a vote of confidence in the American economy. It’s a vote of no-confidence in everyone else. The dollar is rallying because Japan just picked a new leader who dashes hopes of rate hikes and France’s government is imploding. We’re not winning; we’re just losing less badly than the other guys. It’s like being named the tallest person in a room full of children. Congratulations, I guess?

And all this is happening while our own government is shut down. For two weeks! I can’t even get a straight answer from the DMV, but this committee of unelected academics is supposed to be steering a multi-trillion-dollar economy through global political turmoil while the politicians who actually run the country can't even agree to keep the lights on. It's beyond absurd.

This is a sign of deep uncertainty. No, 'uncertainty' is too polite. This is a five-alarm panic behind a thin veneer of bureaucratic calm. Gold just hit $4,000 an ounce. That’s not a sign of a healthy, confident market. That’s a fear gauge. That’s smart money running for the digital hills because they see the same cracks I do. They see a Fed that’s divided, a government that’s paralyzed, and a global economy teetering on the brink of… something.

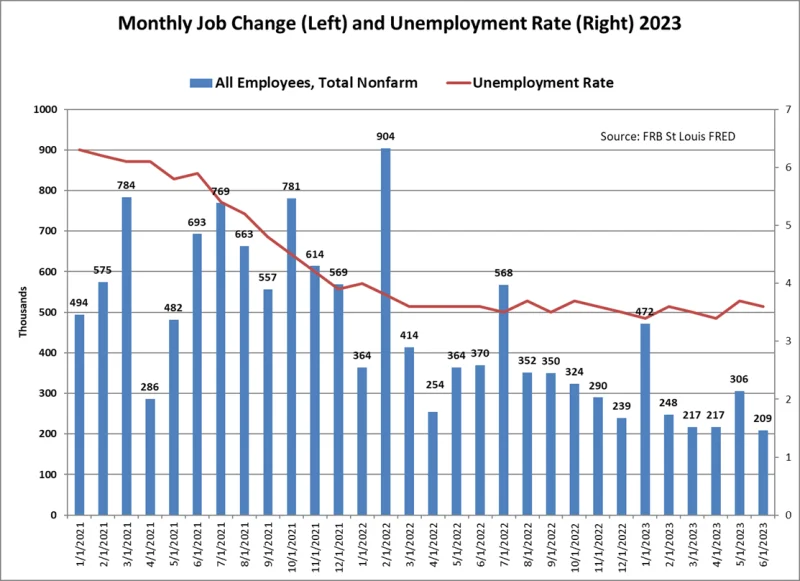

The market may be pricing in more cuts, but it's doing it with gritted teeth. What happens when the labor market weakness the Fed is so worried about actually gets worse? What happens when this 10-9 split becomes a 9-10 split in the other direction, or a complete free-for-all? They're trying to project stability, but all these minutes show is a group that's one bad jobs report away from total chaos. And we're supposed to just nod along and pretend this is all normal—

So We're All Just Pretending, Then?

Let's drop the charade. These minutes don't reveal a plan; they reveal a prayer. The Fed is just as spooked as the rest of us. They're split, they're guessing, and they're using language so vague it's meaningless. They aren't navigating the storm. They're just describing the rain and hoping the boat doesn't sink. The only difference between them and us is that they have better stationery.

-

The Business of Plasma Donation: How the Process Works and Who the Key Players Are

Theterm"plasma"suffersfromas...

-

The Manyu Phenomenon: What Connects the Viral Crypto, the Tennis Star, and the Anime Legend

It’seasytodismisssportsasmer...

-

ASML's Future: The 2026 Vision and Why Its Next Breakthrough Changes Everything

ASMLIsn'tJustaStock,It'sthe...

-

The Nebius AI Breakthrough: Why This Changes Everything

It’snotoftenthatatypo—oratl...

-

The Great Up-Leveling: What's Happening Now and How We Step Up

Haveyoueverfeltlikeyou'redri...

- Search

- Recently Published

-

- Misleading Billions: The Truth About DeFi TVL - DeFi Reacts

- Secure Crypto: Unlock True Ownership - Reddit's HODL Guide

- Altcoin Season is "here.": What's *really* fueling the latest altcoin hype (and who benefits)?

- The Week's Pivotal Blockchain Moments: Unpacking the breakthroughs and their visionary future

- DeFi Token Performance Post-October Crash: What *actual* investors are doing and the brutal 2025 forecast

- Monad: A Deep Dive into its Potential and Price Trajectory – What Reddit is Saying

- MSTR Stock: Is This Bitcoin's Future on the Public Market?

- OpenAI News Today: Their 'Breakthroughs' vs. The Broken Reality

- Medicare 2026 Premium Surge: What We Know and Why It Matters

- Accenture: What it *really* is, its stock, and the AI game – What Reddit is Saying

- Tag list

-

- Blockchain (11)

- Decentralization (5)

- Smart Contracts (4)

- Cryptocurrency (26)

- DeFi (5)

- Bitcoin (30)

- Trump (5)

- Ethereum (8)

- Pudgy Penguins (5)

- NFT (5)

- Solana (5)

- cryptocurrency (6)

- XRP (3)

- Airdrop (3)

- MicroStrategy (3)

- Plasma (4)

- Zcash (7)

- Aster (10)

- qs stock (3)

- mstr stock (3)

- asts stock (3)

- investment advisor (4)

- morgan stanley (3)

- ChainOpera AI (4)

- federal reserve news today (4)