Economic Struggle: What Happened and What We Know

D.C.'s Economic Fever Dream Turns Nightmarish

The Capital Area Food Bank is bracing for a surge in demand, and honestly, anyone who's been paying attention shouldn't be surprised. We're not talking about a blip; we're talking about an anticipated 20% increase in meals needed – 8 million more this budget year. Eight. Million. This isn't just a logistical problem; it's a flashing red indicator of systemic strain.

The Shutdown's Chilling Effect

The shutdown, which started October 1, 2025, is the obvious catalyst. Hundreds of thousands of federal workers – at least 670,000 furloughed nationally, with another 730,000 working without pay – are facing the reality of missed paychecks. The ripple effects are already visible. Ridership on D.C.'s transit system is down roughly 25% since September. It's not just about convenience; it's about people tightening their belts because they don't know when the next check will arrive.

And here's where the data points get particularly grim: the Capital Area Food Bank expects to distribute one million more meals this month than projected before the shutdown. That's a staggering spike, and it points to a deeper vulnerability than just temporary inconvenience. This isn't just about cutting back on lattes; it's about basic sustenance.

The shutdown's halt to SNAP (Supplemental Nutrition Assistance Program) funding is another punch to the gut. We're talking about a program designed to prevent hunger suddenly being switched off. How many families were relying on that assistance as a baseline? What are their options now? These are the questions that should be dominating the conversation, not just the political theater in Congress.

The anecdotal evidence reinforces the quantitative picture. The Queen Vic, a bar in Northeast D.C., is reporting a 50% drop in business. Ryan Gordon, the co-owner, is fortunate enough to own the building, so he doesn't have to worry about rent. But what about the other businesses, the ones without that safety net? How many will be forced to close their doors?

A Perfect Storm of Economic Woes

But let's not pretend the shutdown is the sole culprit. The fact sheet mentions Thea Price, who was fired from her job at the U.S. Institute of Peace back in March. She's now moving back to her hometown near Seattle because she can't afford to stay in D.C. This illustrates a longer trend. D.C. is getting “especially hard hit” because of a series of decisions by the Trump administration, from layoffs to law enforcement intervention. Washington's struggling economy takes another economic hit from the government shutdown - abcnews.go.com

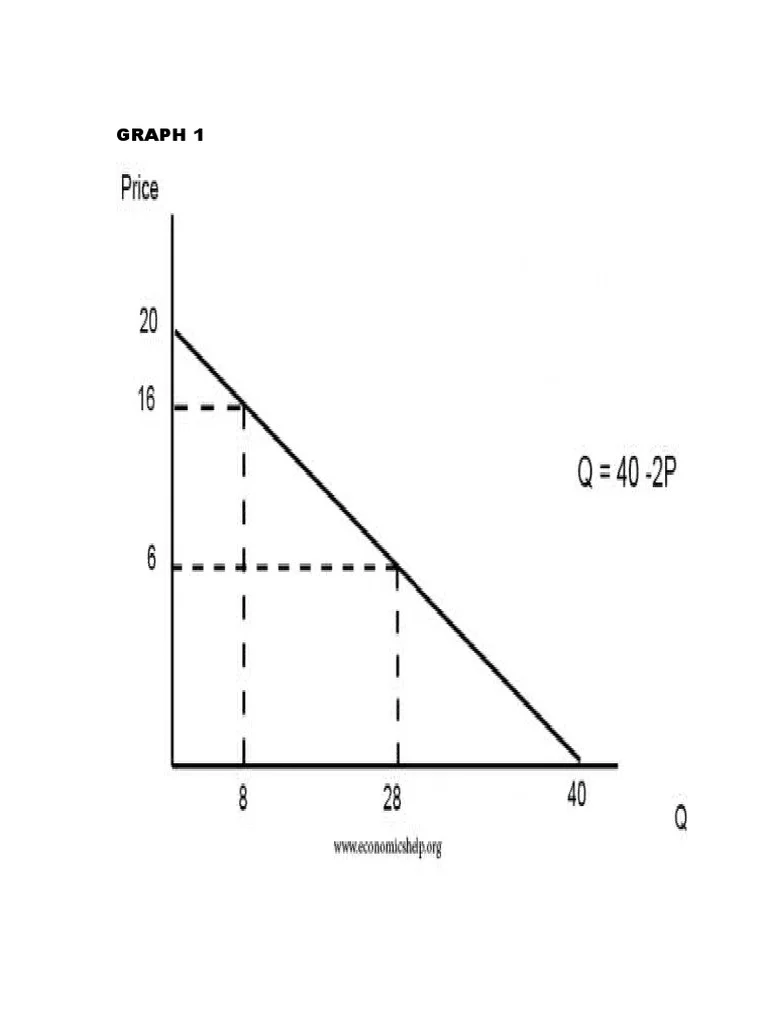

Washington has the largest share of federal workers in the country, roughly 20%. That's approximately 150,000 people in the D.C. area alone. The September jobs report showed a seasonally adjusted unemployment rate of 6% in D.C., compared to a national rate of 4.3%. That’s a significant discrepancy (1.7 percentage points, to be exact).

And this is the part of the analysis that I find genuinely troubling: Radha Muthiah, CEO of the Capital Area Food Bank, is warning about the long-term implications of this crisis. People are tapping into their savings and retirement funds just to get by. This isn't a sustainable strategy. What happens when those resources are exhausted? Are we prepared for the cascading consequences of mass defaults on mortgages and student loans, as Tracy Hadden Loh from Brookings Metro suggests is possible?

The election of Abigail Spanberger as Virginia's governor, focusing on the impact of Trump's actions on the state's economy, is a political signal, certainly. But it's also a reflection of the growing anxiety among voters who are directly experiencing the economic fallout. Are politicians truly grasping the scale of the hardship? Or are they too caught up in their own power games to see the real-world consequences of their actions?

The Illusion of Prosperity Crumbles

D.C. has long enjoyed a reputation as a relatively recession-proof city, insulated by the steady presence of the federal government. But that illusion is now crumbling. The data is clear: the combination of government shutdowns, layoffs, and cuts to social safety nets is creating a perfect storm of economic hardship. And the worst part is, this might just be the beginning.

The Data Screams: "Unsustainable!"

The numbers don't lie. D.C.'s economic stability was always more fragile than it appeared, and now the chickens have come home to roost. The question now is: who will pay the price? And how high will the cost be?

-

The Business of Plasma Donation: How the Process Works and Who the Key Players Are

Theterm"plasma"suffersfromas...

-

The Manyu Phenomenon: What Connects the Viral Crypto, the Tennis Star, and the Anime Legend

It’seasytodismisssportsasmer...

-

ASML's Future: The 2026 Vision and Why Its Next Breakthrough Changes Everything

ASMLIsn'tJustaStock,It'sthe...

-

The Nebius AI Breakthrough: Why This Changes Everything

It’snotoftenthatatypo—oratl...

-

The Great Up-Leveling: What's Happening Now and How We Step Up

Haveyoueverfeltlikeyou'redri...

- Search

- Recently Published

-

- Misleading Billions: The Truth About DeFi TVL - DeFi Reacts

- Secure Crypto: Unlock True Ownership - Reddit's HODL Guide

- Altcoin Season is "here.": What's *really* fueling the latest altcoin hype (and who benefits)?

- The Week's Pivotal Blockchain Moments: Unpacking the breakthroughs and their visionary future

- DeFi Token Performance Post-October Crash: What *actual* investors are doing and the brutal 2025 forecast

- Monad: A Deep Dive into its Potential and Price Trajectory – What Reddit is Saying

- MSTR Stock: Is This Bitcoin's Future on the Public Market?

- OpenAI News Today: Their 'Breakthroughs' vs. The Broken Reality

- Medicare 2026 Premium Surge: What We Know and Why It Matters

- Accenture: What it *really* is, its stock, and the AI game – What Reddit is Saying

- Tag list

-

- Blockchain (11)

- Decentralization (5)

- Smart Contracts (4)

- Cryptocurrency (26)

- DeFi (5)

- Bitcoin (30)

- Trump (5)

- Ethereum (8)

- Pudgy Penguins (5)

- NFT (5)

- Solana (5)

- cryptocurrency (6)

- XRP (3)

- Airdrop (3)

- MicroStrategy (3)

- Plasma (4)

- Zcash (7)

- Aster (10)

- qs stock (3)

- mstr stock (3)

- asts stock (3)

- investment advisor (4)

- morgan stanley (3)

- ChainOpera AI (4)

- federal reserve news today (4)