XRP Price: The Latest News and Why It's Still Not Taking Off

So, you think you’re going to get rich off XRP. You’ve seen the YouTube thumbnails, the wild-eyed predictions on X, the fantasy math about what happens if XRP reaches the market cap of Bitcoin. Let me guess, you’re picturing a future where you pay for your coffee with a fraction of a token while the old banking system crumbles to dust.

It’s a great story. A real David vs. Goliath narrative. The problem is, Goliath just woke up, and David is busy selling his own slingshots for cash.

While the true believers are busy chanting hopium-fueled mantras about a $40 XRP price today, the big money—the so-called "whales"—are quietly, or not so quietly, dumping the stuff to the tune of $50 million. Per day. That’s not a typo. Fifty. Million. Dollars. Every single day, a river of XRP USD is flowing out of the wallets of the largest holders and onto exchanges. XRP whales dump $50M per day: Will it crash the price?

This is just classic market behavior. No, it's worse—it's a calculated fleecing. The insiders build the hype, paint a picture of a glorious future, and then use that optimism as exit liquidity to cash out. But are we supposed to ignore the flashing red lights just because a few partnerships in the Middle East make for a good press release? Give me a break.

The Dinosaur Wakes Up

For years, the bull case for Ripple has been simple: it’s going to replace SWIFT. The creaky, ancient network that banks use to talk to each other is slow, expensive, and ripe for disruption. And for a while, it looked like Ripple and its XRP crypto price might actually pull it off. They were the flashy speedboat zipping around the rusty old battleship.

Well, the battleship is turning its cannons.

SWIFT, the 1973-era behemoth that connects over 11,000 banks, isn’t just rolling over to die. They're building their own blockchain. In partnership with Consensys, they’re creating a system for tokenized assets and real-time settlement. They’re not trying to invent a new currency; they’re upgrading their existing rails, the ones the entire global financial system already runs on. XRP Price Hangs by a Thread as SWIFT Bets on Blockchain to Catch Ripple in Its Own Game

This is the corporate playbook, page one. You don’t innovate, you acquire or assimilate. Why would a bank rip out its entire decades-old infrastructure to plug into Ripple’s system when SWIFT is promising them a blockchain-flavored upgrade to what they already use? SWIFT’s advantage isn’t technology; it’s inertia. It’s the default. Getting thousands of deeply conservative, change-averse financial institutions to switch to something new is next to impossible. Getting them to accept a software update from the provider they already trust? That’s just another Tuesday.

The PR spin is that SWIFT’s system will be more "flexible," supporting various stablecoins and digital assets instead of relying on a single volatile token like XRP. The cynical translation? They’re building a walled garden that keeps the power, and the fees, right where they’ve always been. Are we really supposed to believe the same institutions that have been gouging us on wire transfers for fifty years are suddenly going to pass the savings on to us? Offcourse not.

Selling the Dream, Dumping the Reality

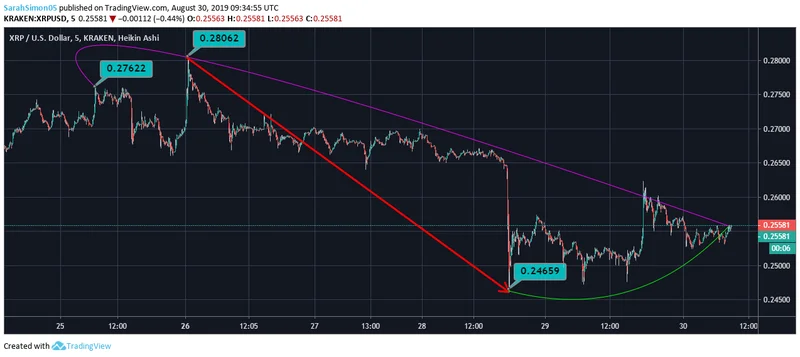

While SWIFT methodically defends its empire, the internal picture for XRP looks less like a revolution and more like a fire sale. The charts don’t lie. We’re seeing a classic descending triangle pattern, a big, ugly shape that usually points to one thing: a steep drop. Veteran trader Peter Brandt is eyeing $2.20 as a target if the support around $2.75 breaks. That’s a 22% haircut from here.

And why wouldn't it break? The futures Open Interest is falling, meaning traders are losing faith. The Relative Strength Index is in the toilet. The MACD, another one of those fancy chart doodads, is screaming "sell." You don't need a finance degree to read these tea leaves. They spell trouble.

This is the part of the cycle where the dreamers get crushed by the pragmatists. The dream is that XRP hits a Bitcoin price market cap and every token is worth over $40. The reality is that large holders are dumping $50 million a day because they see the writing on the wall. Who do you think these whales are? Are they the same people on social media telling you to HODL for generational wealth? The cognitive dissonance is staggering.

I see this all the time, not just in crypto but everywhere. A cool new indie band gets a record deal and their music suddenly sounds like everything else on the radio. A disruptive startup gets bought by a tech giant and its innovative product gets buried in a corporate sub-menu. The system doesn’t get replaced; it just absorbs the threat. It’s not exciting, it ain't fair, but it’s how the world works. Ripple’s recent partnership in Bahrain is a nice little headline, but it feels like re-arranging deck chairs on the Titanic...

The hope for an XRP ETF is the last bastion for the bulls. Maybe SEC approval provides a pump. But if the whales are already positioned to sell, what do you think they’ll do when a wave of new retail money comes rushing in? They’ll use it as the biggest exit liquidity event in history, and the cycle will start all over again.

Same Game, Different Coin

Look, I don’t know if XRP is going to $2.20 or $40. Nobody does. But the narrative that it's a sure-fire bet to overthrow the global financial order is looking shakier by the day. What we're seeing isn't a revolution. It's a hostile takeover attempt, and the incumbent is fighting back with the biggest weapon of all: its own boring, inescapable, globe-spanning network. The dream of a decentralized future is being replaced by the reality of a centralized upgrade. The little guy, as usual, is left holding the bag.

-

The Business of Plasma Donation: How the Process Works and Who the Key Players Are

Theterm"plasma"suffersfromas...

-

ASML's Future: The 2026 Vision and Why Its Next Breakthrough Changes Everything

ASMLIsn'tJustaStock,It'sthe...

-

Morgan Stanley's Q3 Earnings Beat: What This Signals for Tech & the Future of Investing

It’seasytoglanceataheadline...

-

The Manyu Phenomenon: What Connects the Viral Crypto, the Tennis Star, and the Anime Legend

It’seasytodismisssportsasmer...

-

The Great Up-Leveling: What's Happening Now and How We Step Up

Haveyoueverfeltlikeyou'redri...

- Search

- Recently Published

-

- Bitcoin's Recovery: The Numbers Don't Add Up (- Reactions Only)

- Misleading Billions: The Truth About DeFi TVL - DeFi Reacts

- Secure Crypto: Unlock True Ownership - Reddit's HODL Guide

- Altcoin Season is "here.": What's *really* fueling the latest altcoin hype (and who benefits)?

- The Week's Pivotal Blockchain Moments: Unpacking the breakthroughs and their visionary future

- DeFi Token Performance Post-October Crash: What *actual* investors are doing and the brutal 2025 forecast

- Monad: A Deep Dive into its Potential and Price Trajectory – What Reddit is Saying

- MSTR Stock: Is This Bitcoin's Future on the Public Market?

- OpenAI News Today: Their 'Breakthroughs' vs. The Broken Reality

- Medicare 2026 Premium Surge: What We Know and Why It Matters

- Tag list

-

- Blockchain (11)

- Decentralization (5)

- Smart Contracts (4)

- Cryptocurrency (26)

- DeFi (5)

- Bitcoin (30)

- Trump (5)

- Ethereum (8)

- Pudgy Penguins (5)

- NFT (5)

- Solana (5)

- cryptocurrency (6)

- XRP (3)

- Airdrop (3)

- MicroStrategy (3)

- Plasma (4)

- Zcash (7)

- Aster (10)

- qs stock (3)

- mstr stock (3)

- asts stock (3)

- investment advisor (4)

- morgan stanley (3)

- ChainOpera AI (4)

- federal reserve news today (4)