Gold Breaks $4,000: Why It's Surging and Who's Getting Rich (Hint: Not You)

So, gold is over $4,000 an ounce. Pop the champagne, I guess?

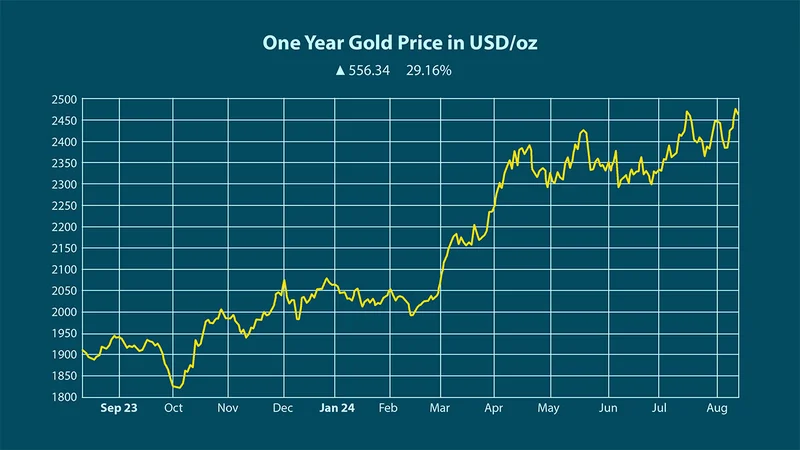

Every major headline is screaming it, treating it like some kind of winning lottery number. "A Historic Rally!" Gold price tops $4,000 for first time as investors seek safe haven. It’s all presented with the breathless excitement of a sports announcer calling the final play of the Super Bowl. But let's be real for a second. Cheering for the price of gold to hit a record high is like celebrating the fact that you’ve finally managed to inflate your life raft. It doesn’t mean you’re winning; it means you’re in the middle of a shipwreck.

This isn't a sign of prosperity. It's a five-alarm fire alarm, a global vote of no confidence in everything we're told to believe in: governments, currencies, the whole damn system. People don't pour billions of dollars into a shiny, yellow metal that just sits there because they're optimistic about the future. They do it because they're terrified of it.

The Fear Trade is Back, Baby

Let’s break down the "why" behind this little gold rush. The fact sheets are a laundry list of chaos. We've got a US government shutdown grinding the country to a halt because politicians can't agree on a budget. We've got a President who thinks the Federal Reserve is his personal piggy bank, publicly trying to fire governors and screaming for rate cuts. We have global trade wars sparked by late-night tweets.

This is the "economic and political uncertainty" the articles mention in their calm, detached business-speak. Let me translate that for you: the people in charge are asleep at the wheel, and the car is headed for a cliff.

So, what do you do? You buy gold. It’s the financial world’s equivalent of a fallout shelter. It’s a bet on disaster. The billionaire Ray Dalio compared this moment to the early 1970s, a period of stagflation and chaos, and advises putting 15% of your portfolio in gold. When a guy who manages one of the largest hedge funds in the world tells you to stock up on the apocalypse-proof asset, you should probably listen. He’s not seeing a temporary dip; he’s seeing a systemic breakdown.

The real tell, though, isn't the retail investors or even the hedge funds. It’s the central banks. The very institutions that print the paper money we're supposed to trust have been buying gold by the metric ton, moving away from the US dollar. China, Poland, Turkey, India—they're all quietly filling their vaults. What message does that send when the dealers start using their own product? It tells me they know something we're only just beginning to suspect: the paper is becoming worthless.

Your 401(k) is a Casino, and the House is on Fire

While everyone is running to gold's cold, metallic embrace, there's another party going on in the room next door, and it’s getting dangerously loud. The stock market, particularly AI tech stocks, is hitting record highs. The Bank of England took one look at this and basically said the valuations "appear stretched," warning of a "sharp correction."

This is a bad sign. No, "bad" doesn't cover it—this is the financial equivalent of hearing the Titanic’s string quartet switch to playing "Nearer, My God, to Thee." They’re comparing the current AI frenzy to the dot-com bubble. Remember that? When companies with no profits and a ".com" in their name were worth billions, right before they were worth nothing? We’re doing it again, just swapping out one buzzword for another.

It's the ultimate market schizophrenia. One half of the financial world is building a bunker, and the other half is betting its life savings on a high-tech lottery ticket. I can almost hear the low, electric hum of the server farms powering this AI bubble, a constant vibration of pure, unadulterated speculation. Meanwhile, somewhere in a Swiss vault, a gold bar just sits there, silent, heavy, and unimpressed.

The average person is caught in the middle. We're told to diversify, but what are our options? You can buy physical gold bars at Costco, right next to the giant tubs of mayonnaise. I'm not even kidding. That’s where we are now. You can buy a gold ETF, which is basically a digital IOU for gold you'll never see. Or you can stick with your stocks and pray the AI bubble doesn't pop. They tell you to diversify, but when the options are a lottery ticket or a lifeboat...

It all feels so fragile. The price of this supposedly stable asset hinges on whether the government shutdown ends a week early, or if Trump backs off firing some Fed official. This ain't a healthy system. It’s a house of cards built on a trampoline, and everyone is just hoping nobody starts jumping. Offcourse, we're all supposed to pretend this is just how things work.

Then again, maybe I'm the crazy one here. Maybe this manic oscillation between blind techno-optimism and primal fear is the new normal. Maybe buying gold from a big-box store is a perfectly rational response to the world we’ve built.

But I have to ask: Are we really making smart investments, or are we just picking our favorite flavor of panic?

It's a Barometer of Our Own Stupidity

Let's stop calling this a "rally" and call it what it is: a fever. The price of gold isn't a reflection of its intrinsic value; it’s a reflection of our collective loss of faith. It’s a measure of how little we trust our leaders, our institutions, and the very currency in our pockets. Four thousand dollars an ounce isn't a price tag. It's an indictment. It’s the market screaming that the people in charge are fundamentally unserious, and that a lump of metal is a more reliable store of value than the full faith and credit of the modern world. And the scariest part? It’s probably right.

-

The Business of Plasma Donation: How the Process Works and Who the Key Players Are

Theterm"plasma"suffersfromas...

-

ASML's Future: The 2026 Vision and Why Its Next Breakthrough Changes Everything

ASMLIsn'tJustaStock,It'sthe...

-

Morgan Stanley's Q3 Earnings Beat: What This Signals for Tech & the Future of Investing

It’seasytoglanceataheadline...

-

The Manyu Phenomenon: What Connects the Viral Crypto, the Tennis Star, and the Anime Legend

It’seasytodismisssportsasmer...

-

The Nebius AI Breakthrough: Why This Changes Everything

It’snotoftenthatatypo—oratl...

- Search

- Recently Published

-

- Misleading Billions: The Truth About DeFi TVL - DeFi Reacts

- Secure Crypto: Unlock True Ownership - Reddit's HODL Guide

- Altcoin Season is "here.": What's *really* fueling the latest altcoin hype (and who benefits)?

- The Week's Pivotal Blockchain Moments: Unpacking the breakthroughs and their visionary future

- DeFi Token Performance Post-October Crash: What *actual* investors are doing and the brutal 2025 forecast

- Monad: A Deep Dive into its Potential and Price Trajectory – What Reddit is Saying

- MSTR Stock: Is This Bitcoin's Future on the Public Market?

- OpenAI News Today: Their 'Breakthroughs' vs. The Broken Reality

- Medicare 2026 Premium Surge: What We Know and Why It Matters

- Accenture: What it *really* is, its stock, and the AI game – What Reddit is Saying

- Tag list

-

- Blockchain (11)

- Decentralization (5)

- Smart Contracts (4)

- Cryptocurrency (26)

- DeFi (5)

- Bitcoin (30)

- Trump (5)

- Ethereum (8)

- Pudgy Penguins (5)

- NFT (5)

- Solana (5)

- cryptocurrency (6)

- XRP (3)

- Airdrop (3)

- MicroStrategy (3)

- Plasma (4)

- Zcash (7)

- Aster (10)

- qs stock (3)

- mstr stock (3)

- asts stock (3)

- investment advisor (4)

- morgan stanley (3)

- ChainOpera AI (4)

- federal reserve news today (4)