MARA Stock's Bitcoin Bet: What Its Strategy Means for the Future

Decoding the Chaos: Why Marathon Digital's Wild Ride Is the Most Important Story in Finance

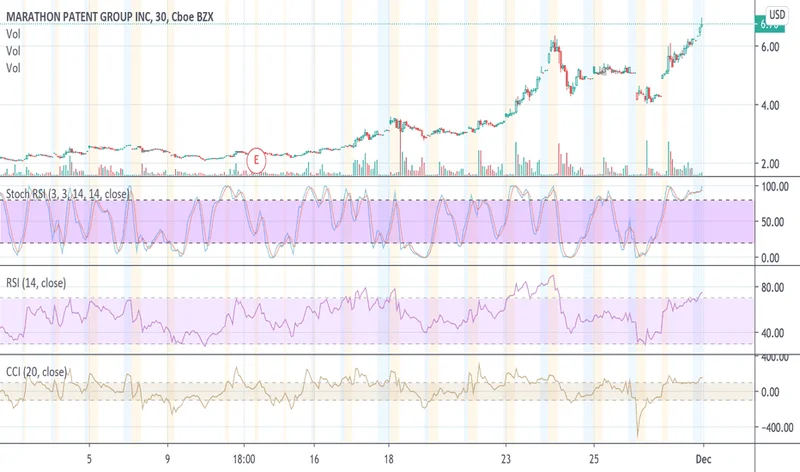

You see the headlines and your stomach drops. Or maybe it leaps. With Marathon Digital, it’s usually a bit of both. One day, the stock is carving out a beautiful, bullish “cup-and-handle” pattern, a classic signal that has technical traders salivating, with analysts whispering about breakout targets of $26 or even $28. The company is mining Bitcoin at a staggering rate—736 BTC in a single month—as detailed in reports like MARA Stock Charts Cup-And-Handle Breakout As Marathon Digital Mines 736 Bitcoin In September. Its treasury is swelling, second only to the colossal holdings of Michael Saylor’s MicroStrategy.

Then you blink.

The next day’s alert screams across your screen in angry red: MARA is down 7.87%. Rumors of insider trading slither through the market’s digital corridors. You see a company with a five-year revenue growth of 252% that somehow feels… restrained. You see a current ratio of 0.5—in simpler terms, that means for every dollar of bills due in the short-term, the company only has 50 cents in easily accessible assets to cover them. It’s a liquidity tightrope walk that would make a traditional CFO break out in a cold sweat.

It’s dizzying. It’s contradictory. And if you’re only looking at it as a stock, you’re missing the point entirely. When I see this data, this beautiful, chaotic mess of soaring production and precarious financials, I honestly just sit back in my chair, speechless for a moment. This isn't the story of one company's balance sheet. This is the real-time, high-stakes, unfiltered story of a technological revolution trying to price itself into existence.

The Engine and the Frame

Let’s be clear: the numbers surrounding Marathon Digital are a paradox wrapped in an enigma. On one side, you have the engine—a machine of pure, unadulterated operational power. The company boasts an EBIT margin of 157.6%. For anyone not steeped in financial jargon, that’s an absolutely staggering figure. It means that for every dollar of revenue, after accounting for the core costs of doing business, they are left with about $1.57 in earnings. This isn't just efficient; it's a testament to the sheer profitability of mining Bitcoin when the gears are turning correctly. They are pulling digital gold out of the ether at a world-class pace.

But then you look at the frame this engine is bolted to. The financials reveal a company navigating treacherous waters. The debt-to-equity ratio is moderate, but the liquidity concerns are real. The stock price swings from a high of $22 to a close of $18 in a single, whirlwind week. It’s the financial equivalent of strapping a Formula 1 engine to a wooden go-kart. The power is undeniable, but you’re constantly wondering if the whole thing is going to shake itself apart on the next turn.

So, what are we to make of this? Is it a sign of a fatal flaw, a house of cards waiting for a stiff breeze? Or is it something else? Is this what the bleeding edge of innovation actually looks like, stripped of the clean, curated narratives we get years after the fact? Think about the early days of the automobile. The first cars were loud, unreliable, and dangerous. They broke down constantly and there were no paved roads or gas stations. If you judged the entire concept of personal transportation based on the balance sheet of a single, fledgling car company in 1905, you would’ve called it a reckless, foolish gamble. You would have missed the birth of the modern world.

This Isn't Volatility; It's a Paradigm Shift Being Priced in Real Time

We’re conditioned to see this kind of market behavior as pure risk, part of what some call The Unpredictable Ride of MARA’s Stock. The analyst Tim Bohen is quoted saying, “Time and experience have taught me that missed opportunities are part of the game. There’s always another setup around the corner.” It’s wise, prudent advice for a traditional trader. But what if MARA isn’t just another “setup”? What if it’s a proxy for the entire, messy, glorious transition to a new financial operating system?

The volatility we’re seeing isn’t a bug; it’s the central feature. We are watching a decentralized, non-sovereign store of value (Bitcoin) and the industrial infrastructure that secures it (companies like Marathon) fight for a foothold in a world dominated by centuries-old financial systems. The speed of this is just staggering—it means the gap between the old world of centralized banking and the new world of decentralized protocols is closing faster than our legacy institutions can even comprehend, and companies like MARA are caught right in the turbulent slipstream.

Of course, this journey isn't without its perils. The whiplash in stock price affects real people, real investments, and real futures. We have a profound responsibility to build this new system with care, to ensure it’s more equitable and transparent than the one it seeks to augment. But to dismiss the entire enterprise because of the turbulence is to mistake the growing pains of childbirth for a terminal illness.

What does it mean when a company can mine 218 blocks in a month, directly contributing to the security of a global, permissionless financial network, yet still face liquidity questions from Wall Street? It means the old metrics are struggling to measure a new kind of value. How do you properly value a company whose primary asset is a cryptographically secured, digital bearer instrument that has no precedent in human history? The market doesn't know. And that "not knowing" is what creates the chaos—and the opportunity.

This Isn't a Stock, It's a Stress Test

So, forget the day-to-day noise for a second. The frantic tug-of-war between $18 and $22 isn't the real story. The real story is that we have a front-row seat to one of the most profound economic experiments in a century. Marathon Digital isn’t just a company to be analyzed; it's a living stress test for our financial convictions. It challenges us to decide whether we believe in the disruptive power of decentralization, even when it’s messy, unpredictable, and frankly, a little bit scary. This volatility isn't a warning sign to run away. It's the price of admission to watch the future being built.

-

The Business of Plasma Donation: How the Process Works and Who the Key Players Are

Theterm"plasma"suffersfromas...

-

ASML's Future: The 2026 Vision and Why Its Next Breakthrough Changes Everything

ASMLIsn'tJustaStock,It'sthe...

-

Morgan Stanley's Q3 Earnings Beat: What This Signals for Tech & the Future of Investing

It’seasytoglanceataheadline...

-

The Manyu Phenomenon: What Connects the Viral Crypto, the Tennis Star, and the Anime Legend

It’seasytodismisssportsasmer...

-

The Nebius AI Breakthrough: Why This Changes Everything

It’snotoftenthatatypo—oratl...

- Search

- Recently Published

-

- Misleading Billions: The Truth About DeFi TVL - DeFi Reacts

- Secure Crypto: Unlock True Ownership - Reddit's HODL Guide

- Altcoin Season is "here.": What's *really* fueling the latest altcoin hype (and who benefits)?

- The Week's Pivotal Blockchain Moments: Unpacking the breakthroughs and their visionary future

- DeFi Token Performance Post-October Crash: What *actual* investors are doing and the brutal 2025 forecast

- Monad: A Deep Dive into its Potential and Price Trajectory – What Reddit is Saying

- MSTR Stock: Is This Bitcoin's Future on the Public Market?

- OpenAI News Today: Their 'Breakthroughs' vs. The Broken Reality

- Medicare 2026 Premium Surge: What We Know and Why It Matters

- Accenture: What it *really* is, its stock, and the AI game – What Reddit is Saying

- Tag list

-

- Blockchain (11)

- Decentralization (5)

- Smart Contracts (4)

- Cryptocurrency (26)

- DeFi (5)

- Bitcoin (30)

- Trump (5)

- Ethereum (8)

- Pudgy Penguins (5)

- NFT (5)

- Solana (5)

- cryptocurrency (6)

- XRP (3)

- Airdrop (3)

- MicroStrategy (3)

- Plasma (4)

- Zcash (7)

- Aster (10)

- qs stock (3)

- mstr stock (3)

- asts stock (3)

- investment advisor (4)

- morgan stanley (3)

- ChainOpera AI (4)

- federal reserve news today (4)