The UUUU Stock Hype Train: What's Actually Driving the Surge and Why I'm Not Buying It

Let’s get one thing straight. A company losing nearly $100 million a year on about $65 million in revenue shouldn't be worth close to $5 billion. In a sane world, that’s a penny stock on a death watch, not a market darling rocketing up 377% in a year. But we don't live in a sane world. We live in the age of the geopolitical panic trade, and Energy Fuels (UUUU) is its poster child.

The whole thing is a circus. The stock pops 20% in an afternoon because President Trump tweets something vaguely threatening about China, then walks it back with a casual "it will all be fine!" This isn't investing; it's trying to read tea leaves from a firehose. The market has become a twitchy, neurotic mess that reacts to shadows, and right now, the biggest shadows are being cast by Beijing and Moscow.

Energy Fuels is a uranium miner. Or, it was mostly a uranium miner. Now, it’s pivoting hard into processing rare-earth elements, the secret sauce in everything from your iPhone to an F-35 fighter jet. And since China controls something like 90% of the global processing, any American company with a plausible plan to do it on US soil is suddenly treated like the second coming of Standard Oil.

The company’s CEO, Mark Chalmers, talks about "strong investor sentiment." Let me translate that for you: he means raw, uncut fear. Fear that China will turn off the spigot. Fear that we can't build our own EV magnets or missile guidance systems. Energy Fuels isn't selling uranium or rare-earth oxides; it's selling a hedge against global chaos.

The Hype Machine is Overheating

Every bull case for UUUU hinges on things that haven't happened yet. The company is going to be a key part of the US supply chain. It’s going to ramp up production. Its recent technical breakthroughs, like making 99.9% pure dysprosium oxide, are genuinely impressive, but they're pilot programs. They're lab successes. Scaling that to a commercial operation that can actually compete with China’s state-subsidized machine is a whole different beast.

This is like a home-run hitter who just got called up from the minor leagues after hitting one out in batting practice. The potential is there, sure, but Wall Street is already pricing him for the Hall of Fame. The company’s recent $700 million convertible debt raise was a massive success—oversubscribed, even. But what does that really prove? It proves there’s a ton of cash out there desperate for a story that sounds good, a story that taps into the zeitgeist of onshoring and national security.

The whole situation is a perfect metaphor for the modern economy: a company’s value has become completely detached from its actual performance and is now almost entirely based on its narrative potential. It's like a backup generator company whose stock price is determined not by how many generators it sells, but by the daily weather forecast. The darker the storm clouds on the horizon, the higher the stock goes, even if the factory hasn't shipped a single unit. But what happens when the sun comes out?

Digging for Gold in a Field of IOUs

Let's look at the books, because nobody else seems to want to. In the second quarter of 2025, Energy Fuels pulled in a whopping $4.2 million in revenue. For that, it posted a net loss of almost $22 million. This is a bad business model. No, 'bad' doesn't cover it—this is a five-alarm dumpster fire of a balance sheet being propped up by geopolitical hope and a firehose of investor cash.

The company has a market cap of $4.7 billion. Its trailing-twelve-month revenue is $65 million. That gives it a price-to-sales ratio that would make a dot-com era software company blush. And they ain’t even profitable. This isn’t just pricing in future growth; it’s pricing in a future where Energy Fuels is the sole supplier of critical minerals to the entire Western world.

And I get it, I do. They own the only licensed conventional uranium mill in the country, the White Mesa Mill. That’s a massive strategic asset, a piece of infrastructure that simply can’t be replicated overnight. They're making real moves, and the government is practically begging companies like them to succeed. But the gap between that reality and a multi-billion dollar valuation is a chasm filled with execution risk. They are trying to build an airplane while flying it through a hurricane, and everyone's just betting they don't crash...

It’s just another symptom of the sickness in our markets. We don't reward companies for building profitable, sustainable businesses anymore. We reward them for positioning themselves to catch the next wave of government subsidies or for being the subject of the right fearful headline. It’s all just a grift, from top to bottom.

So, Are the Shorts Suicidal or Just Early?

Of course, for every bull high on hopium, there’s a bear sniffing out the rot. The short interest in UUUU is sitting at a spicy 12% of the float. These are the people betting on gravity. They're looking at the same financials I am and seeing a house of cards. They’re betting that eventually, fundamentals have to matter.

But in this market, that might be a sucker’s bet. The bulls see that high short interest not as a warning, but as rocket fuel. If the stock keeps climbing—pushed higher by another Chinese export threat or a new bill out of Congress to build a strategic uranium reserve—those shorts will be forced to buy back their shares to cover their losses. That buying pressure creates a feedback loop, a short squeeze that could send this already absurdly-priced stock into orbit.

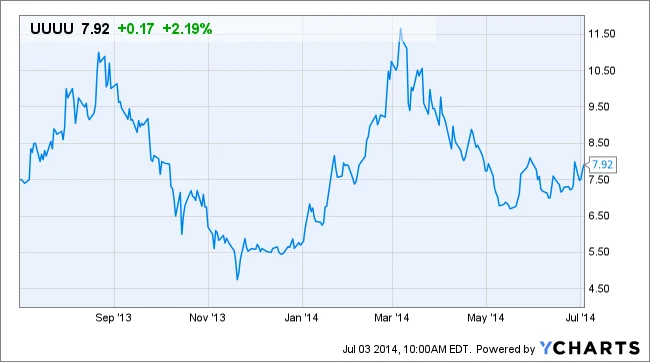

I look at this chart, I read the quarterly reports, and all my instincts scream "bubble." But then I watch the stock climb another 10%. I see the geopolitical tensions ratcheting up. Maybe I’m the crazy one here. Maybe I’m the dinosaur who still thinks revenue and profit should have some relationship to a company's market cap. Then again, maybe the world really has changed, and the most valuable commodity isn't gold or oil, but a good story. Offcourse, stories don't pay the bills forever.

The entire thing is a high-stakes poker game. On one side of the table, you have the fundamentals—a pile of IOUs. On the other, you have the narrative—a stack of chips backed by the full faith and credit of global anxiety. Who’s going to win? Don’t ask me. I just write about the madness.

A Lottery Ticket with a Flag on It

When you strip away all the noise, buying UUUU stock right now isn't an investment in a company. It's a pure, unadulterated bet on continued global instability. You're not buying a business; you're buying a call option on a trade war, a supply chain collapse, or worse. The valuation makes zero sense in a world at peace. It only begins to look rational if you believe the apocalypse is just around the corner. Maybe it is. But don't you dare pretend this is about sound financial analysis. It's fear, packaged and sold on the open market.

-

The Business of Plasma Donation: How the Process Works and Who the Key Players Are

Theterm"plasma"suffersfromas...

-

ASML's Future: The 2026 Vision and Why Its Next Breakthrough Changes Everything

ASMLIsn'tJustaStock,It'sthe...

-

Morgan Stanley's Q3 Earnings Beat: What This Signals for Tech & the Future of Investing

It’seasytoglanceataheadline...

-

The Manyu Phenomenon: What Connects the Viral Crypto, the Tennis Star, and the Anime Legend

It’seasytodismisssportsasmer...

-

The Nebius AI Breakthrough: Why This Changes Everything

It’snotoftenthatatypo—oratl...

- Search

- Recently Published

-

- Misleading Billions: The Truth About DeFi TVL - DeFi Reacts

- Secure Crypto: Unlock True Ownership - Reddit's HODL Guide

- Altcoin Season is "here.": What's *really* fueling the latest altcoin hype (and who benefits)?

- The Week's Pivotal Blockchain Moments: Unpacking the breakthroughs and their visionary future

- DeFi Token Performance Post-October Crash: What *actual* investors are doing and the brutal 2025 forecast

- Monad: A Deep Dive into its Potential and Price Trajectory – What Reddit is Saying

- MSTR Stock: Is This Bitcoin's Future on the Public Market?

- OpenAI News Today: Their 'Breakthroughs' vs. The Broken Reality

- Medicare 2026 Premium Surge: What We Know and Why It Matters

- Accenture: What it *really* is, its stock, and the AI game – What Reddit is Saying

- Tag list

-

- Blockchain (11)

- Decentralization (5)

- Smart Contracts (4)

- Cryptocurrency (26)

- DeFi (5)

- Bitcoin (30)

- Trump (5)

- Ethereum (8)

- Pudgy Penguins (5)

- NFT (5)

- Solana (5)

- cryptocurrency (6)

- XRP (3)

- Airdrop (3)

- MicroStrategy (3)

- Plasma (4)

- Zcash (7)

- Aster (10)

- qs stock (3)

- mstr stock (3)

- asts stock (3)

- investment advisor (4)

- morgan stanley (3)

- ChainOpera AI (4)

- federal reserve news today (4)