Critical Metals (CRML) Stock Is Surging: Decoding the Surge and What It Signals for the Next Tech Revolution

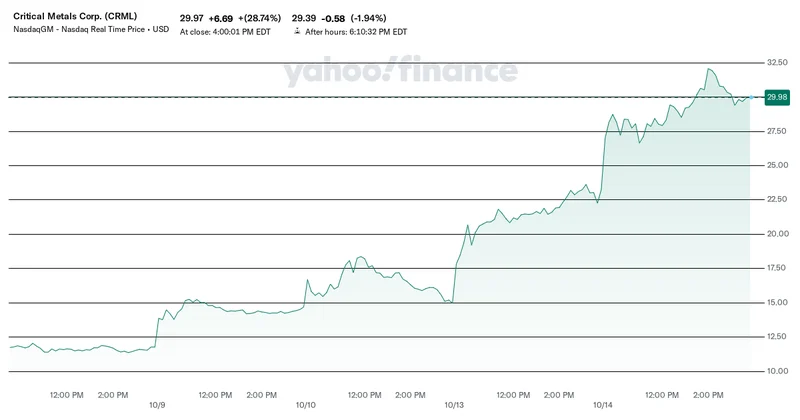

Every so often, a signal cuts through the market noise—a signal so clear and powerful it tells a story far bigger than a single company’s stock chart. The recent, frankly astonishing, surge of Critical Metals Corp. (CRML) is one of those moments. We’re talking about a stock that has climbed nearly 250% in the last month and an eye-watering 2,200% since March. It's no wonder that headlines are asking, Why Is Critical Metals Stock (CRML) Soaring Today?.

If you’re just looking at this as a financial headline, you’re missing the entire picture. This isn't just another meme stock or a speculative bubble. What we are witnessing, I believe, is the first tremor of a massive geological and geopolitical shift. This is the sound of America waking up and beginning the monumental task of declaring its technological independence.

For decades, we in the tech world have built a dazzling digital civilization on a physical foundation we don't control. We design revolutionary chips, write elegant code for AI, and build world-changing renewable energy grids. But the physical ingredients—the blood and bones of our modern world—have increasingly come from a single, centralized source. This has been the digital world's Achilles' heel, a vulnerability so profound we chose, for years, to simply ignore it.

Until now.

The Geopolitical Chessboard Resets

Let’s be brutally honest about the situation. The entire 21st-century economy runs on a specific class of materials. These aren't just any minerals; they're the so-called "rare earth elements"—which, to be clear, aren't always geologically rare, but are incredibly difficult and messy to process into the high-purity forms our technology demands. Your iPhone, the magnets in an F-35 fighter jet, the motor in a Tesla, the giant turbines spinning in the wind—they are all utterly dependent on them. And for years, China has methodically secured a near-monopoly on their processing and supply.

What happens when the source of those materials decides to turn off the tap? That’s not a hypothetical question anymore.

President Trump’s recent threats of 100% tariffs and Beijing’s subsequent tightening of export controls on five more rare earth elements was the geopolitical equivalent of a fire alarm being pulled in the dead of night. It was a stark, undeniable reminder that supply chains are not just logistical tools; they are instruments of power. Suddenly, a company like Critical Metals—with its flagship Tanbreez Project in Southern Greenland, one of the world’s largest heavy rare earth deposits outside of China—doesn’t just look like a good investment. It looks like a strategic necessity.

When I saw JPMorgan's announcement, I honestly had to read it twice. It wasn't the staggering number—$10 billion in direct equity as part of a $1.5 trillion national security initiative—that made me sit up. It was the language. The raw, almost wartime urgency from Jamie Dimon, the CEO of America's largest bank: “It has become painfully clear that the United States has allowed itself to become too reliant on unreliable sources.”

Painfully clear. That’s not Wall Street talk. That’s a call to action.

The Architects of a New Foundation

This is where the story pivots from problem to solution, from anxiety to action. The surge in CRML isn’t just a reaction to fear; it’s being fueled by the tangible, concrete steps being taken to build an alternative. Think of it less as a stock rally and more as a barn-raising for a 21st-century industrial commons.

You have the financial cavalry arriving in the form of JPMorgan, pledging not just capital but advisory support to build this new ecosystem. Then you see the architecture of the new supply chain being sketched out in real-time. Critical Metals just signed a letter of intent for a 10-year deal with REalloys Inc. to supply rare earth concentrate from its Greenland project. This isn’t just a press release; it’s a foundational brick being laid for a secure, resilient North American supply chain. You can almost picture the engineers and geologists, their boots dusty from the field, sitting across from financiers in a glass-walled boardroom, hammering out the details that will power our future.

Suddenly you have geopolitics, national security policy, and colossal private capital all converging on this one critical point at the same time and the momentum is building so fast it feels less like a market trend and more like a tectonic shift. This feels like the early days of the space race, when a national imperative—spurred by a geopolitical rival—unleashed a torrent of innovation and investment that changed the world in ways no one could have predicted.

Of course, this is a high-stakes game. The path to true independence is never smooth, and the market’s enthusiasm is running far ahead of production realities. Wall Street’s lone analyst has a price target that implies significant downside risk, a reminder that mining is a capital-intensive, long-term endeavor fraught with uncertainty. It's a valid concern that raises a key question for anyone watching the stock: This Rare Earth Stock Just Hit a New All-Time High. Should You Buy It Here? Building this new foundation also comes with immense responsibility. We must ensure that this quest for resource independence doesn't come at an unacceptable environmental or social cost, especially in pristine regions like Greenland. Are we prepared to build this new future the right way?

But the direction of travel is now unmistakable. For the first time in a generation, the digital and physical worlds are aligning their interests. We are finally recognizing that you cannot build a secure future on borrowed ground.

The Bedrock of Tomorrow is Being Laid Today

Let's zoom out. Forget the daily stock price. What we're seeing with Critical Metals is a proxy vote on a new American idea. It’s the market betting that we will choose to build, to invest, and to secure the very foundations of our technological society. This isn’t just about reshoring; it’s about reimagining. It’s about building a resilient, diversified, and sovereign supply chain not just for defense, but for the clean energy transition that will define this century. This is the hard, unglamorous, and absolutely essential work of creating the future. And it’s finally happening.

-

The Business of Plasma Donation: How the Process Works and Who the Key Players Are

Theterm"plasma"suffersfromas...

-

ASML's Future: The 2026 Vision and Why Its Next Breakthrough Changes Everything

ASMLIsn'tJustaStock,It'sthe...

-

Morgan Stanley's Q3 Earnings Beat: What This Signals for Tech & the Future of Investing

It’seasytoglanceataheadline...

-

The Manyu Phenomenon: What Connects the Viral Crypto, the Tennis Star, and the Anime Legend

It’seasytodismisssportsasmer...

-

The Nebius AI Breakthrough: Why This Changes Everything

It’snotoftenthatatypo—oratl...

- Search

- Recently Published

-

- Misleading Billions: The Truth About DeFi TVL - DeFi Reacts

- Secure Crypto: Unlock True Ownership - Reddit's HODL Guide

- Altcoin Season is "here.": What's *really* fueling the latest altcoin hype (and who benefits)?

- The Week's Pivotal Blockchain Moments: Unpacking the breakthroughs and their visionary future

- DeFi Token Performance Post-October Crash: What *actual* investors are doing and the brutal 2025 forecast

- Monad: A Deep Dive into its Potential and Price Trajectory – What Reddit is Saying

- MSTR Stock: Is This Bitcoin's Future on the Public Market?

- OpenAI News Today: Their 'Breakthroughs' vs. The Broken Reality

- Medicare 2026 Premium Surge: What We Know and Why It Matters

- Accenture: What it *really* is, its stock, and the AI game – What Reddit is Saying

- Tag list

-

- Blockchain (11)

- Decentralization (5)

- Smart Contracts (4)

- Cryptocurrency (26)

- DeFi (5)

- Bitcoin (30)

- Trump (5)

- Ethereum (8)

- Pudgy Penguins (5)

- NFT (5)

- Solana (5)

- cryptocurrency (6)

- XRP (3)

- Airdrop (3)

- MicroStrategy (3)

- Plasma (4)

- Zcash (7)

- Aster (10)

- qs stock (3)

- mstr stock (3)

- asts stock (3)

- investment advisor (4)

- morgan stanley (3)

- ChainOpera AI (4)

- federal reserve news today (4)