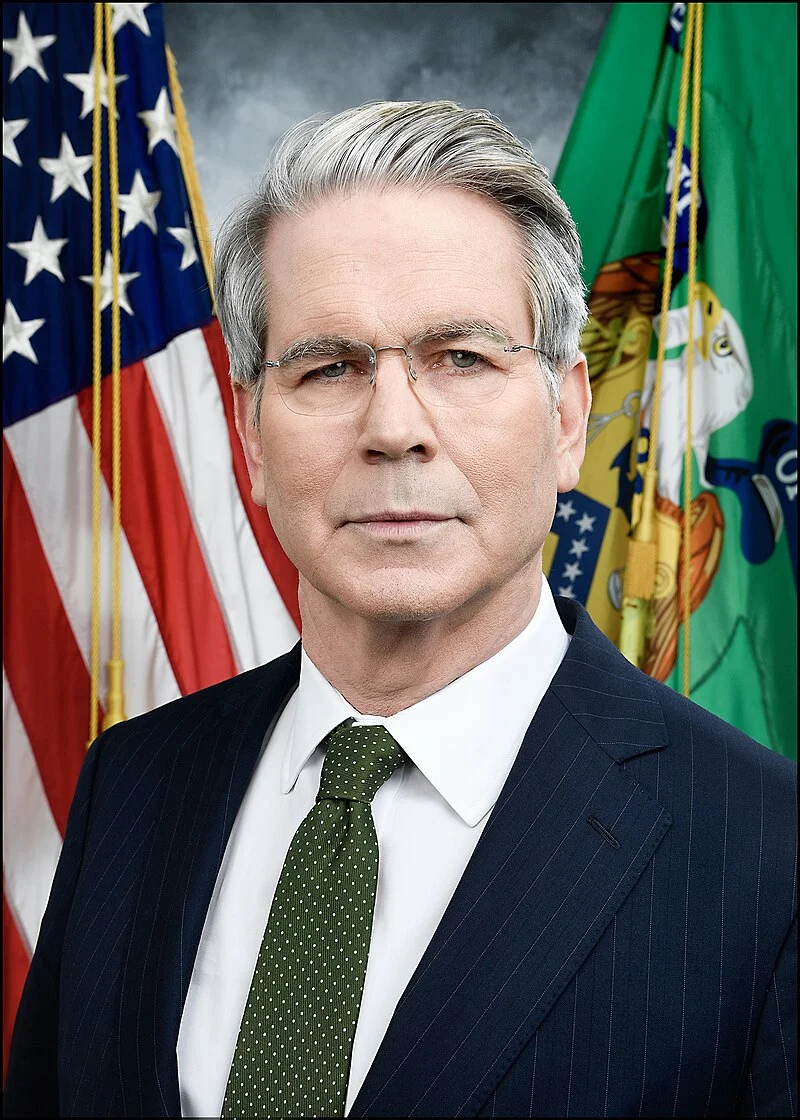

Scott Bessent: Analyzing His Track Record and Potential Treasury Role

The Unseen Risk in America's $20 Billion Bet on Argentina

The announcement from Treasury Secretary Scott Bessent arrived as most market-moving news does these days: not through a formal press release, but via a social media post. The United States has begun purchasing Argentine pesos and has finalized terms for a $20 billion currency swap line. The stated goal is to calm a spiraling currency crisis in a country run by a key White House ally, Javier Milei.

On the surface, the logic is straightforward. The Treasury is acting as the lender of last resort, a financial backstop to prevent a regional crisis from metastasizing. Bessent, a man who built his career betting on currency fluctuations, declared the success of Argentina’s "reform agenda" to be of "systemic importance." He even claimed the peso was "undervalued."

These are the official variables. But my analysis suggests the most critical risk in this entire operation has not been priced in, because it cannot be found on any Bloomberg terminal. The real risk isn't financial; it's the danger of misdiagnosing a political problem as a currency problem.

Deconstructing the Intervention

Let’s be precise about what this "rescue" entails. The purchase of pesos, the amount of which remains conspicuously undisclosed, is a direct injection of confidence. The $20 billion currency swap line is more significant. It’s essentially a credit line that allows Argentina’s central bank to exchange its rapidly depreciating pesos for stable U.S. dollars. (A currency swap isn't a gift; it's a loan of credibility backed by dollars.) This provides a war chest to defend the peso and meet upcoming debt obligations.

The context is a classic emerging-market crisis. President Milei’s free-market reforms and severe cost-cutting measures are facing a crucial test ahead of the national midterm elections on October 26th. Following a recent provincial election loss, investors began dumping Argentine assets, accelerating the peso's decline and draining the country’s dollar reserves. The debt payments are due in a few months—to be more exact, with a major tranche coming due just before the midterms, creating a perfect storm of financial and political pressure.

The Treasury Department has been tight-lipped on the specifics. Inquiries about the size of the initial peso purchase or the interest rates and collateral on the swap line were met with silence. This lack of transparency is the first red flag. I've looked at dozens of sovereign debt arrangements and IMF packages, and while details can be slow to emerge, the level of opacity here is unusual for an operation of this scale. It begs the question: are the terms unfavorable, or is the goal of the intervention something other than pure financial stabilization?

The official U.S. position is that a stable Argentina is a "strategic interest" that should be a "bipartisan priority." But the immediate, sharp criticism from figures like Senator Elizabeth Warren highlights the domestic political friction. Indeed, news reports framed the event as the moment the US kicks off controversial financial rescue plan for Argentina. Pledging $20 billion to another country while domestic spending is a battleground is a difficult position to defend. It tells us this isn't a routine financial maneuver; it's a high-stakes play by the administration.

The Financial Firebreak and the Trader's Gambit

To understand the mechanics of the risk, think of the $20 billion swap line as a financial firebreak. In wildfire management, you clear a line of vegetation to stop a blaze from spreading. The swap line is supposed to be that—a clear, credible line in the sand that tells markets, "The panic stops here; behind this line is the full faith and credit of the U.S. Treasury." When it works, the fire dies down before it even reaches the break.

But firebreaks can fail. If the fire is hot enough and the winds are strong enough, embers can jump the line, rendering it useless and even trapping the firefighters. Here, the "wind" is market sentiment, and it's being driven by political uncertainty surrounding Milei's government. If investors don't believe his reforms will survive the midterms, they will continue to sell pesos, regardless of the swap line.

This is where the presence of Scott Bessent becomes so fascinating. This is a man who, as a currency trader, was on the other side of a similar event: the 1992 "Black Wednesday," when the Bank of England was forced to devalue the pound despite massive intervention. He knows, intimately, how a determined market can break a central bank. Now, as Treasury Secretary, he's the one drawing the line in the sand. Is this the confidence of a seasoned expert, or the hubris of a trader who believes he can now control the very forces he once profited from?

His claim that the peso is "undervalued" is particularly telling. "Undervalued" is a subjective judgment, not an objective fact, especially during a panic. It sounds less like a clinical assessment from a Treasury Secretary and more like a trader talking his book. He is not just providing liquidity; he is trying to jawbone the market into believing his position. What happens if the market calls his bluff? If that $20 billion is tested and fails to hold the line, the intervention doesn't just fail quietly. It fails spectacularly, confirming the market's worst fears and turning the firebreak into a new source of fuel for the crisis. The signal would be catastrophic: even the mighty U.S. Treasury couldn't stop the bleeding.

The Real Variable Isn't the Peso. It's Politics.

When you strip away the financial jargon, this operation looks less like a bailout and more like a political hedge. The timing, just ahead of crucial midterms for a key political ally, is not a coincidence. The U.S. isn't just buying pesos; it's buying time for Javier Milei's administration. It's a bet that a temporarily stable currency will be enough to get him through an election.

The fundamental miscalculation here is treating a crisis of political confidence as a technical liquidity problem. The swap line can provide dollars, but it cannot print political capital. It cannot convince voters to stick with painful austerity if they've already decided it isn't working.

The greatest unseen risk, therefore, is that the United States has tied the credibility of its Treasury to the electoral success of a foreign political party. The $20 billion isn't the amount at risk. The real collateral is the perception of U.S. financial power. If the peso breaks anyway because the political winds in Argentina shift, the loss won't be measured in basis points. It will be measured in the diminished authority of the U.S. dollar as a tool of global stability. This isn't a rescue; it's a lever, and levers can snap.

-

The Business of Plasma Donation: How the Process Works and Who the Key Players Are

Theterm"plasma"suffersfromas...

-

ASML's Future: The 2026 Vision and Why Its Next Breakthrough Changes Everything

ASMLIsn'tJustaStock,It'sthe...

-

Morgan Stanley's Q3 Earnings Beat: What This Signals for Tech & the Future of Investing

It’seasytoglanceataheadline...

-

The Manyu Phenomenon: What Connects the Viral Crypto, the Tennis Star, and the Anime Legend

It’seasytodismisssportsasmer...

-

The Nebius AI Breakthrough: Why This Changes Everything

It’snotoftenthatatypo—oratl...

- Search

- Recently Published

-

- Misleading Billions: The Truth About DeFi TVL - DeFi Reacts

- Secure Crypto: Unlock True Ownership - Reddit's HODL Guide

- Altcoin Season is "here.": What's *really* fueling the latest altcoin hype (and who benefits)?

- The Week's Pivotal Blockchain Moments: Unpacking the breakthroughs and their visionary future

- DeFi Token Performance Post-October Crash: What *actual* investors are doing and the brutal 2025 forecast

- Monad: A Deep Dive into its Potential and Price Trajectory – What Reddit is Saying

- MSTR Stock: Is This Bitcoin's Future on the Public Market?

- OpenAI News Today: Their 'Breakthroughs' vs. The Broken Reality

- Medicare 2026 Premium Surge: What We Know and Why It Matters

- Accenture: What it *really* is, its stock, and the AI game – What Reddit is Saying

- Tag list

-

- Blockchain (11)

- Decentralization (5)

- Smart Contracts (4)

- Cryptocurrency (26)

- DeFi (5)

- Bitcoin (30)

- Trump (5)

- Ethereum (8)

- Pudgy Penguins (5)

- NFT (5)

- Solana (5)

- cryptocurrency (6)

- XRP (3)

- Airdrop (3)

- MicroStrategy (3)

- Plasma (4)

- Zcash (7)

- Aster (10)

- qs stock (3)

- mstr stock (3)

- asts stock (3)

- investment advisor (4)

- morgan stanley (3)

- ChainOpera AI (4)

- federal reserve news today (4)